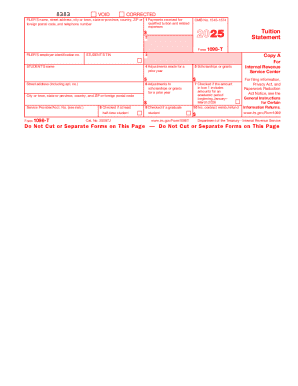

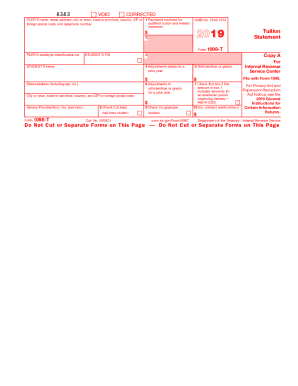

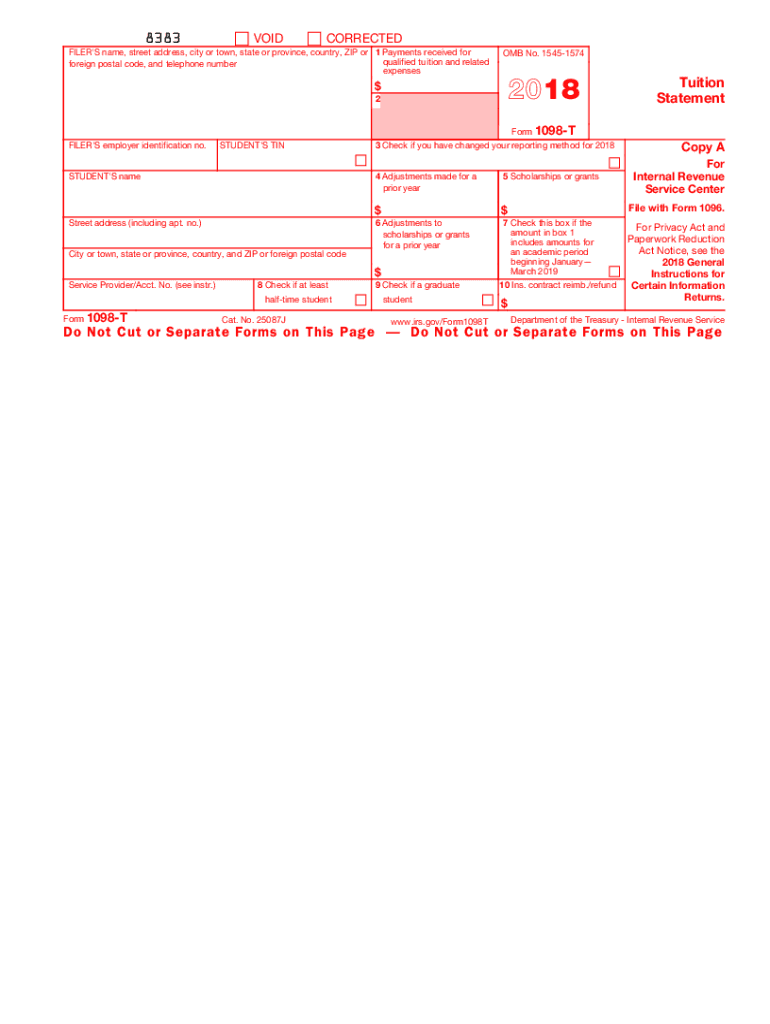

IRS 1098-T 2018 free printable template

Instructions and Help about IRS 1098-T

How to edit IRS 1098-T

How to fill out IRS 1098-T

About IRS 1098-T 2018 previous version

What is IRS 1098-T?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What payments and purchases are reported?

What are the penalties for not issuing the form?

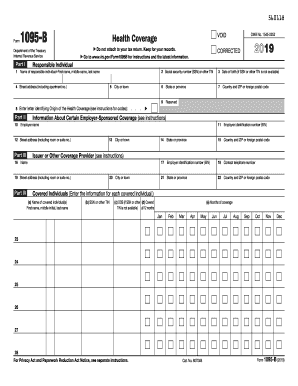

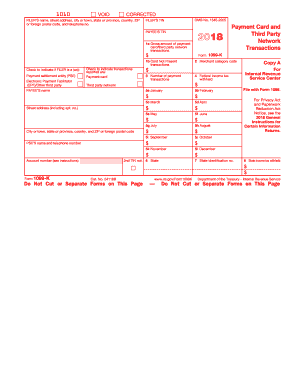

Is the form accompanied by other forms?

FAQ about IRS 1098-T

What should I do if I need to correct an error on my IRS 1098-T?

If you find an error on your IRS 1098-T after filing, you must submit a corrected version of the form. This involves filling out a new 1098-T with the correct information and marking it as 'corrected.' Additionally, it’s essential to retain documentation justifying the changes for your records.

How can I verify if my IRS 1098-T has been received by the IRS?

To verify the receipt of your IRS 1098-T, you can contact the IRS directly after a few weeks of submission or use the IRS's 'Where's My Refund?' tool, which may provide insights on processed forms. Make sure to have your personal details and submission records handy for reference.

What should I do if I receive a notice from the IRS related to my 1098-T?

In the event you receive an IRS notice regarding your 1098-T, it's crucial to read the documentation carefully to understand the issue. Prepare relevant documentation and respond within the specified timeframe. If necessary, consult a tax professional for assistance in addressing the notice.

Are e-signatures acceptable when filing my IRS 1098-T?

Yes, e-signatures are acceptable for submitting your IRS 1098-T, provided they meet the IRS's authenticity standards. Ensure your electronic submission system is compliant with legal requirements and verifies the identity of the signer.

What common mistakes should I avoid when filing the IRS 1098-T?

To avoid common mistakes with the IRS 1098-T, double-check all taxpayer identification numbers and amounts reported. Ensure that you're familiar with the specific requirements for education expenses. Review previous submissions for consistency and accuracy to minimize errors.

See what our users say